CORRESP: Correspondence

Published on December 11, 2024

|

Eversheds Sutherland (US) LLP

700 Sixth Street, NW, Suite 700

Washington, DC 20001-3980

D: +1 202.383.0218

F: +1 202.637.3593

cynthiakrus@eversheds-sutherland.com

|

||||

December 11, 2024

Via EDGAR

U.S. Securities and Exchange Commission

Division of Investment Management

Attention: Ms. Anu Dubey and Ms. Megan Miller

100 F Street, N.E.

Washington, D.C. 20549

Re: Blue Owl Technology Finance Corp. – Registration Statement on Form N-14 (File No. 333-283413)

Dear Mses. Dubey and Miller:

On behalf of Blue Owl Technology Finance Corp. (the “Company” or “OTF”), set forth below is the Company’s response to the oral comments provided by the staff of the Division of Investment Management (the “Staff”) of the U.S. Securities and Exchange Commission (the “SEC”), on December 4, 2024 and December 5, 2024, regarding the Company’s registration statement on Form N-14 (the “Registration Statement”), and the joint proxy statement/prospectus contained therein, as initially filed with the SEC on November 22, 2024. Each of the Staff’s comments is set forth below and followed by the Company’s response. Unless otherwise indicated, all page references are to page numbers in the Registration Statement. Capitalized terms used herein but not defined shall have the meanings ascribed to them in the Registration Statement.

Legal

1.Comment: On page 11, in the answer to the question “What transfer restrictions apply to OTF Common Stock?”, clarify the disclosure regarding whether OTF Common Stock not issued in connection with the Mergers will still be subject to restrictions on transfer by law because such shares are not registered under the 1933 Act.

1

Eversheds Sutherland (US) LLP is part of a global legal practice, operating through various separate and distinct legal entities, under Eversheds Sutherland. For a full description of the structure and a list of offices, please visit www.eversheds-sutherland.com.

Response: The Company has revised the answer to this question to add the language underlined below:

OTF Common Stock is not currently registered under the Securities Act or any state securities law and is subject to restrictions as to transfer by law and pursuant to the terms of the OTF Subscription Agreements. If the Amended OTF Charter is not approved and the Mergers do not occur, OTF Common Stock will continue to be subject to such restrictions.

If the Amended OTF Charter is approved, OTF Common Stock (including, if the Mergers occur, any OTF Common Stock issued in connection with the Mergers) will instead be subject to the restrictions on transfer as provided in the Amended OTF Charter. The restrictions on transfer in the Amended OTF Charter will supersede those in the OTF Subscription Agreements but the OTF Subscription Agreements will otherwise remain in effect. If the Amended OTF Charter is approved, OTF Common Stock will continue to be subject to restrictions as to transfer by law.

See “Questions and Answers about the Merger–What changes are being proposed in the Amended OTF Charter?” and “Questions and Answers about the Amended OTF Charter–How do the transfer restrictions included in the Amended OTF Charter differ from the transfer restrictions included in the OTF Subscription Agreements?”

2.Comment: On page 11, in the answer to the question “How will the combined company be managed following the Second Merger?”, clarify the disclosure to indicate that OTF II Adviser is the adviser to OTF II. Also disclose if the portfolio managers for each fund are the same or not, and whether the portfolio managers are expected to be those of OTF after the Mergers.

Response: The Company has revised the answer to this question to add the language underlined below:

OTF and OTF II have the same directors and officers and OTF will continue to have the same directors and officers following the Mergers. The directors of OTF immediately prior to the Second Merger will remain the directors of OTF and will hold office until their respective successors are duly elected and qualify, or their earlier death, resignation or removal. The officers of OTF immediately prior to the Second Merger will remain the officers of OTF and will hold office until their respective successors are duly appointed and qualify, or their earlier death, resignation or removal. OTF II Adviser is the investment adviser to OTF II and is affiliated with OTF Adviser. OTF II Adviser and OTF Adviser have the same officers and employees. Both OTF and OTF II consider the members of the Technology Lending Investment Committee, which is identical for both OTF Adviser and OTF II Adviser, to be their portfolio managers and these individuals are Douglas I. Ostrover, Marc S. Lipschultz, Craig W. Packer, Alexis Maged, Erik Bissonnette, Pravin Vazirani and Jon ten Oever. Following the Second Merger, OTF Adviser will continue to be the investment adviser of OTF and the portfolio managers of OTF will continue to be the portfolio managers of OTF.

2

3.Comment: On page 26, under “Reasons for the Mergers–OTF”, disclose whether or not the OTF Board considered that total operating expenses will increase for the combined fund when compared to OTF’s expenses and disclose how that affects the OTF Board’s determinations regarding “financing cost savings” and “elimination of duplicative expenses.”

Response: The Company has revised the disclosure to add the additional explanation underlined below:

The OTF Board and the OTF Special Committee consulted with OTF’s management, OTF Adviser, as well as its legal and other advisors and considered numerous factors, including the unanimous recommendation of OTF Independent Directors, and determined that the Mergers are in OTF’s best interests and the best interests of OTF Shareholders, and that OTF Shareholders will not suffer any dilution for purposes of Rule 17a-8 under the 1940 Act as a result of the Mergers. The OTF Board and the OTF Special Committee considered that the number of shares of OTF Common Stock to be issued to OTF II Shareholders pursuant to the Merger Agreement will be determined on a NAV-for-NAV basis.

Certain material factors considered by the OTF Board and the OTF Special Committee (comprised solely of the OTF Independent Directors) that favored the conclusion of the OTF Board and the OTF Special Committee that the Mergers are in OTF’s best interests and the best interests of OTF Shareholders included, among others:

•the expected increased scale and diversification of the combined company;

•the acquisition of a known, high-quality portfolio of assets;

•the greater scale and structural simplification of the combined company could allow for greater access to debt markets and financing costs savings over time;

•the potential for operational synergies via the elimination of duplicative expenses post-closing;

•the expectation that the Mergers would be accretive to OTF’s NII;

•similarities in the investment strategies and risks of OTF and OTF II;

•the continuity of the Blue Owl-affiliated management team;

•the tax consequences of the Mergers;

•no dilution for purposes of Rule 17a-8 under the 1940 Act;

•the potential benefits of the Mergers as compared to other strategic options;

•the opinions of RBCCM and Truist Securities, dated November 12, 2024, to the OTF Special Committee as to the fairness, from a financial point of view and as of the date of the opinion, of the estimated Exchange Ratio provided for in the Mergers to OTF, which opinions were based on and subject to various assumptions made, procedures followed, matters considered, and limitations and

3

qualifications on the scope of review undertaken by RBCCM and Truist Securities, respectively, as more fully described below in the section entitled “The Mergers—Opinions of the OTF Special Committee’s Financial Advisors”; and

•information provided by SMBC and ING, co-financial advisors to the OTF Special Committee.

The OTF Board and the OTF Special Committee considered that initially, on a pro forma basis, as of September 30, 2024, total estimated annual expenses of the combined company would increase following the merger as a result of OTF II’s higher interest payments on borrowed funds (including the cost of servicing and offering debt securities). The OTF Board and the OTF Special Committee considered that in the long-term the potential for greater access to debt markets and financing costs savings over time resulting from the greater scale and structural simplification of the combined company would outweigh any increased expenses in the short-term. See “Comparative Fees and Expenses” for additional information.

4.Comment: On page 29, revise the risk factor entitled “OTF may be unable to realize the benefits anticipated by the Mergers, including estimated cost savings, or it may take longer than anticipated to achieve such benefits.” given that OTF’s total expenses go up on a pro forma basis after the Mergers. This comment also applies to the second to last sentence on page 29 that states “OTF also expects to achieve certain cost savings from the Mergers when the two companies have fully integrated their portfolios.”

Response: The Company has revised the disclosure to add the additional explanation underlined below:

OTF may be unable to realize the benefits anticipated by the Mergers, including estimated operating cost savings and financing costs savings over time, or it may take longer than anticipated to achieve such benefits.

The realization of certain benefits anticipated as a result of the Mergers will depend in part on the integration of OTF II’s investment portfolio with OTF’s investment portfolio and the integration of OTF II’s business with OTF’s business. There can be no assurance that OTF II’s investment portfolio or business can be operated profitably or integrated successfully into OTF’s operations in a timely fashion or at all. The dedication of management resources to such integration may detract attention from the day-to-day business of the combined company, and there can be no assurance that there will not be substantial costs associated with the transition process or that there will not be other material adverse effects as a result of these integration efforts. Such effects, including incurring unexpected costs or delays in connection with such integration and failure of OTF II’s investment portfolio to perform as expected, could have a material adverse effect on the financial results of the combined company.

OTF also expects to achieve certain cost savings from the Mergers when the two companies have fully integrated their portfolios; however, in the short-term total annual

4

expenses of the combined company are likely to increase as a result of OTF II’s higher interest payments on borrowed funds (including the cost of servicing and offering debt securities). It is possible that the estimates of the potential cost savings, including the potential financing costs savings resulting from the greater scale and structural simplification of the combined company could ultimately be incorrect in which case the combined company’s total annual expenses as a percentage of net assets attributable to common stock, could be higher than OTF’s total annual expenses as a percentage of net assets attributable to common stock on a stand-alone basis.

The cost savings estimates also assume OTF will be able to combine the operations of OTF and OTF II in a manner that permits those cost savings to be fully realized. In addition, immediately after the occurrence of the Effective Time and prior to the Second Merger, the OTF II Investment Advisory Agreement and the OTF II Administration Agreement shall be automatically terminated, and OTF II shall be responsible for any final or outstanding payments owed under these agreements, which could impact estimates and cost savings. If the estimates turn out to be incorrect or if OTF is not able to combine OTF II’s investment portfolio or business with the operations of OTF successfully, the anticipated cost savings may not be fully realized or realized at all or may take longer to realize than expected.

5.Comment: On page 57, under “Greater Access to Debt Markets and Financing Cost Savings,” disclose how the OTF Board considered higher total expenses of OTF after the Mergers in relation to these financing cost savings.

Response: The Company has revised the disclosure to add the additional explanation underlined below:

Greater Access to Debt Markets and Financing Cost Savings

The OTF Board and the OTF Special Committee discussed how the combined company may create potential for more diverse funding sources and create financing cost savings over time. The OTF Board and the OTF Special Committee noted the advantages of increased scale when issuing debt, as larger BDCs have historically issued in the institutional bond market at lower spreads. The OTF Board and the OTF Special Committee noted that in the short-term total annual expenses of the combined company are likely to increase as a result of OTF II’s higher interest payments on borrowed funds (including the cost of servicing and offering debt securities) but considered that in the long run, a larger, combined company may be able to refinance debt at lower spreads than OTF as a standalone entity which would outweigh any increased expenses in the short-term. Furthermore, it was determined that larger, more liquid credit platforms historically have paid lower underwriting fees. Finally, the OTF Board and the OTF Special Committee assessed the impact of reduced revolver and rating agency costs associated with a larger, combined company compared to OTF as a standalone entity.

5

6.Comment: On page 57, under “Accretive to NII,” revise the second and third sentences given that OTF will have a higher expense profile on a pro forma basis.

Response: The Company has revised the disclosure to add the additional explanation underlined below:

Accretive to NII

The OTF Board and the OTF Special Committee considered the earnings profile of OTF and the potential earnings profile of the combined company while evaluating the Mergers and determined that the Mergers would be accretive to NII. The OTF Board and the OTF Special Committee noted that in the short-term total annual expenses of the combined company are likely to increase as a result of OTF II’s higher interest payments on borrowed funds (including the cost of servicing and offering debt securities) but considered the lower expense profile the combined company could have, through optimizing its financing structure, lowering financing costs from scale over time, and eliminating redundant professional services and corporate expenses which would outweigh any increased expenses in the short-term. In aggregate, these savings were estimated to total approximately $19 million annually in the long term. Additionally, the OTF Board and the OTF Special Committee determined that NII could benefit further from incremental portfolio-level yield from the asset mix of the combined company. The OTF Board and the OTF Special Committee concluded that a combined company would have an advantageous NII return profile compared to OTF alone as a result.

7.Comment: On page 57, under “Operational Synergies,” revise the second sentence to reflect that annual operating expenses increase after the Mergers.

Response: The Company has revised the disclosure to add the additional explanation underlined below:

Operational Synergies

The OTF Board and the OTF Special Committee reviewed the list of redundant professional services and other expenses associated with each BDC and determined that the potential operating expenses of the combined company would be less than the sum of the operating expenses of OTF and OTF II on a standalone basis. The OTF Board noted that although certain one-time merger related expenses would be borne by OTF Shareholders, the annual operating expenses (excluding borrowing expenses and advisory fees) of the combined company are expected to be reduced as a percentage of net assets due to the elimination of redundant expenses.

6

8.Comment: On page 60, under “Greater Access to Debt Markets and Financing Cost Savings,” revise the second sentence of the last paragraph to disclose who the lower costs are compared to.

Response: The Company has revised the disclosure to add the additional explanation underlined below:

Greater Access to Debt Markets and Financing Cost Savings

The OTF II Board and the OTF II Special Committee discussed how the combined company may be able to optimize its financing structure and create financing cost savings over time. The OTF II Board and the OTF II Special Committee noted the advantages of increased scale when issuing debt as larger BDCs have historically issued in the institutional bond market at lower spreads. The OTF II Board and the OTF II Special Committee considered that in the long run, a larger, combined company may be more able to refinance debt at lower spreads with lower underwriting discounts than OTF II as a standalone entity. Furthermore, it was determined that larger, more liquid credit platforms historically have paid lower underwriting fees. The OTF II Board and the OTF II Special Committee assessed the impact of reduced revolver and rating agency costs associated with a larger, combined company compared to OTF II as a standalone entity.

The OTF II Board and the OTF II Special Committee also considered the current cost of funds at OTF II compared to OTF. In the event of a merger, the combined company should have lower relative unsecured financing costs compared to OTF II continuing as a standalone BDC. The OTF II Board and the OTF II Special Committee concluded that there could be immediate advantages to OTF II Shareholders through a reduced cost of debt in the event of a merger.

9.Comment: On page 61, under “Accretive to NII,” clarify in the second paragraph that the lower expense profile of the combined company is in comparison to OTF II.

Response: The Company has revised the disclosure to add the additional explanation underlined below:

Accretive to NII

The OTF II Board concluded that the Mergers would be advantageous for OTF II Shareholders as the Mergers would result in NII accretion compared to OTF II as a standalone entity. The OTF II Board and the OTF II Special Committee reviewed the relative NII yields of both OTF and OTF II, and determined OTF II Shareholders would gain the immediate benefit of the lower cost of financing at OTF as a result of the Mergers.

The OTF II Board and the OTF II Special Committee also considered the earnings profile of OTF II and the potential earnings profile of the combined company while

7

evaluating the Mergers and determined that the potential NII of a combined company could be greater than OTF II continuing as a standalone BDC. The OTF II Board and the OTF II Special Committee considered the lower expense profile the combined company could have compared to OTF II continuing as a standalone BDC, through optimizing its financing structure, lowering financing costs from scale over time, and eliminating redundant professional services and corporate expenses. In aggregate, these savings were estimated to total approximately $19 million annually in the long term. The OTF II Board and the OTF II Special Committee concluded that a combined company would have an advantageous NII return profile compared to OTF II alone as a result.

10.Comment: On page 61, under “Operational Synergies,” disclose for which entities expenses are to be reduced.

Response: The Company has revised the disclosure to add the additional explanation underlined below:

Operational Synergies

The OTF II Board and the OTF II Special Committee reviewed the list of redundant professional services and other expenses associated with each BDC and determined that the potential operating expenses of the combined company would be less than the sum of the operating expenses of OTF and OTF II on a standalone basis. The OTF II Board noted that although certain one-time merger related expenses would be borne by OTF II Shareholders, the annual operating expenses (excluding borrowing expenses and advisory fees) of the combined company are expected to be reduced as a percentage of net assets due to the elimination of redundant expenses. The OTF II Board and the OTF II Special Committee found that the expected decrease in the expenses of the combined company as compared to the expenses of OTF II as a standalone BDC would benefit OTF II and OTF II Shareholders if the Mergers are approved.

11.Comment: On page 123, disclose that the Amended OTF Charter includes increasing the number of authorized common shares or explain to the Staff why that is not necessary to add.

Response: The Company respectfully advises the Staff that it is not necessary to add this disclosure because the MGCL does not require shareholder approval to amend a corporation’s charter to increase the number of authorized shares of the corporation. Section 2-105(13) of the MGCL states:

“That the board of directors, with the approval of a majority of the entire board, and without action by the stockholders, may amend the charter to increase or decrease the aggregate number of shares of stock of the corporation or the number of shares of stock of any class or series that the corporation has authority to issue.”

8

OTF could amend the Current OTF Charter at any time without shareholder approval to increase the number of shares it is authorized to issue; however, it is choosing to do so in connection with the Mergers as a matter of efficiency. Should the Amended OTF Charter not be approved by OTF Shareholders, OTF may still choose to amend the Current OTF Charter to increase the number of shares it is authorized to issue.

12.Comment: On page 195, under “Limitation on Liability of Directors and Officers; Indemnification and Advance of Expenses,” please add “for money damages” to the last sentence of the first paragraph per Section 6.01 of the Current OTF Charter.

Response: The Company has revised the Registration Statement accordingly.

13.Comment: On page 204, under “Limitation on Liability of Directors and Officers; Indemnification and Advance of Expenses,” please add “for money damages” to the last sentence of the first paragraph per Section 6.01 of the OTF II Charter.

Response: The Company has revised the Registration Statement accordingly.

14.Comment: On page 212, under “Comparison of OTF and OTF II Shareholder Rights,” please also include in the introductory paragraph a brief narrative summary of the material difference in shareholder rights.

Response: The Company has added the language underlined below to the introductory paragraph:

The following is a summary of the material differences between the rights of OTF Shareholders and OTF II Shareholders, which are related to transfer restrictions on shares of each company’s common stock following a Listing. The Current OTF Charter does not subject shares of OTF Common Stock to any transfer restrictions; however, shares of OTF Common Stock issued in the OTF Private Offering are subject to restrictions on transfer contained in the OTF Subscription Agreements. The OTF II Charter subjects all shares of OTF II Common Stock to transfer restrictions. The transfer restrictions in the OTF Subscription Agreements and in the OTF II Charter are not the same. The Amended OTF Charter includes restrictions on the transfer of shares of OTF Common Stock that are identical to those contained in the OTF II Charter and approval of the Amended OTF Charter is a condition to closing the Mergers.

The following discussion is not intended to be complete and is qualified by reference to the OTF Charter and OTF Bylaws, the OTF II Charter and OTF II Bylaws, and the MGCL. Information about the rights of OTF Shareholders and OTF II Shareholders can be found in the OTF Charter and OTF Bylaws and the OTF II Charter and OTF II Bylaws. The OTF Charter is incorporated herein by reference to Exhibit (1) and the OTF Bylaws are incorporated herein by reference to Exhibit (2) in this joint proxy statement/prospectus and will be sent to OTF Shareholders upon request. The OTF II Charter and OTF II Bylaws are incorporated herein by reference to Exhibits 3.1 and 3.2 in “Part IV. Item 15. Exhibits, Financial Statement Schedules” in OTF II’s Annual Report on Form

9

10-K for the fiscal year ended December 31, 2023, and will be sent to OTF II Shareholders upon request. See “Where You Can Find More Information.”

15.Comment: Include an undertaking in Item 17 that the final Opinions and Consents supporting tax matters will be filed in a post-effective amendment within a reasonable time after the receipt of the Opinions and Consents.

Response: The Company has revised the Registration Statement accordingly.

16.Comment: Please provide the Staff with exhibits 17(e) and 17(f) as part of correspondence for the Staff to review.

Response: The Company has provided copies of exhibits 17(e) and 17(f) attached hereto as Annex A and Annex B.

Accounting

1.Comment: On Page 11, in the answer to the question “How will the combined company be managed following the Second Merger?” the disclosure states “…OTF Adviser and OTF II Adviser do not anticipate any significant repositioning of OTF II’s investment portfolio outside of the normal course of investment operations. Additionally, the Mergers will not result in a material change to OTF II’s investment portfolio due to investment restrictions or a change in accounting policies.” Please consider stating this information in the accounting information section in addition to “Questions and Answers About the Special Meetings and the Mergers.”

Response: The Company has added the disclosure as requested as a new paragraph at the end of the section “Accounting Treatment of the Mergers” on page 111.

2.Comment: On page 42, under “Capitalization,” please indicate which amounts are stated in thousands.

Response: The Company has revised the Registration Statement accordingly.

3.Comment: On page 42, under “Capitalization,” please explain supplementally how the “Total Capitalization” line item on the capitalization table was calculated.

Response: On a supplemental basis, the Company respectfully advises the Staff that “Total Capitalization” was calculated as the sum of (1) outstanding debt, net of deferred financing costs and (2) net assets as of September 30, 2024.

10

4.Comment: On page 42, under “Capitalization,” please provide the accounting guidance to capitalize and defer costs on one fund but incur expenses for the other fund as noted in footnote (1).

Response: On a supplemental basis, the Company respectfully advises the Staff that transaction expenses of the acquirer will be capitalized and deferred, while transaction expenses of the acquiree will be expensed as incurred in accordance with ASC 805.

5.Comment: On page 111, under “Accounting Treatment of the Mergers,” after the discussion in the last sentence of the second paragraph, please provide an estimate of any unrealized gains and losses that would occur.

Response: The Company has revised the Registration Statement to note that as of September 30, 2024, Blue Owl Technology Finance Corp. II has inception to date unrealized gains of $30.3 million. However, on a supplemental basis, the Company respectfully notes to the Staff that unrealized gains or losses will vary based on the fair value of the Blue Owl Technology Finance Corp. II portfolio as of the merger closing date.

6.Comment: Please explain how OTF meets the requirements to show the past ten years of senior securities and financial highlights information.

Response: The Company respectfully advises the Staff that OTF was formed on July 12, 2018, and has provided the required information in its senior securities table in the Registration Statement as of December 31, 2023, 2022, 2021, 2020, 2019 and 2018. With respect to the financial highlights information, the Company respectfully notes to the Staff that Instruction 3 to Item 4.1 requires a registrant to present the information in comparative columns for each of the last ten fiscal years of the Registrant (or for the life of the Registrant and its immediate predecessors, if less), but only for periods subsequent to the effective date of the registrant’s first Securities Act registration statement. The Company’s registration statement on Form N-2 became effective on June 7, 2021.

* * *

11

Please do not hesitate to contact me at (202) 383-0218, Kristin Burns at (212) 287-7023 or Dwaune Dupree (202) 383-0206 if you should need further information or clarification.

| Sincerely, | ||

| /s/ Cynthia M. Krus | ||

| Cynthia M. Krus | ||

12

Annex A

13

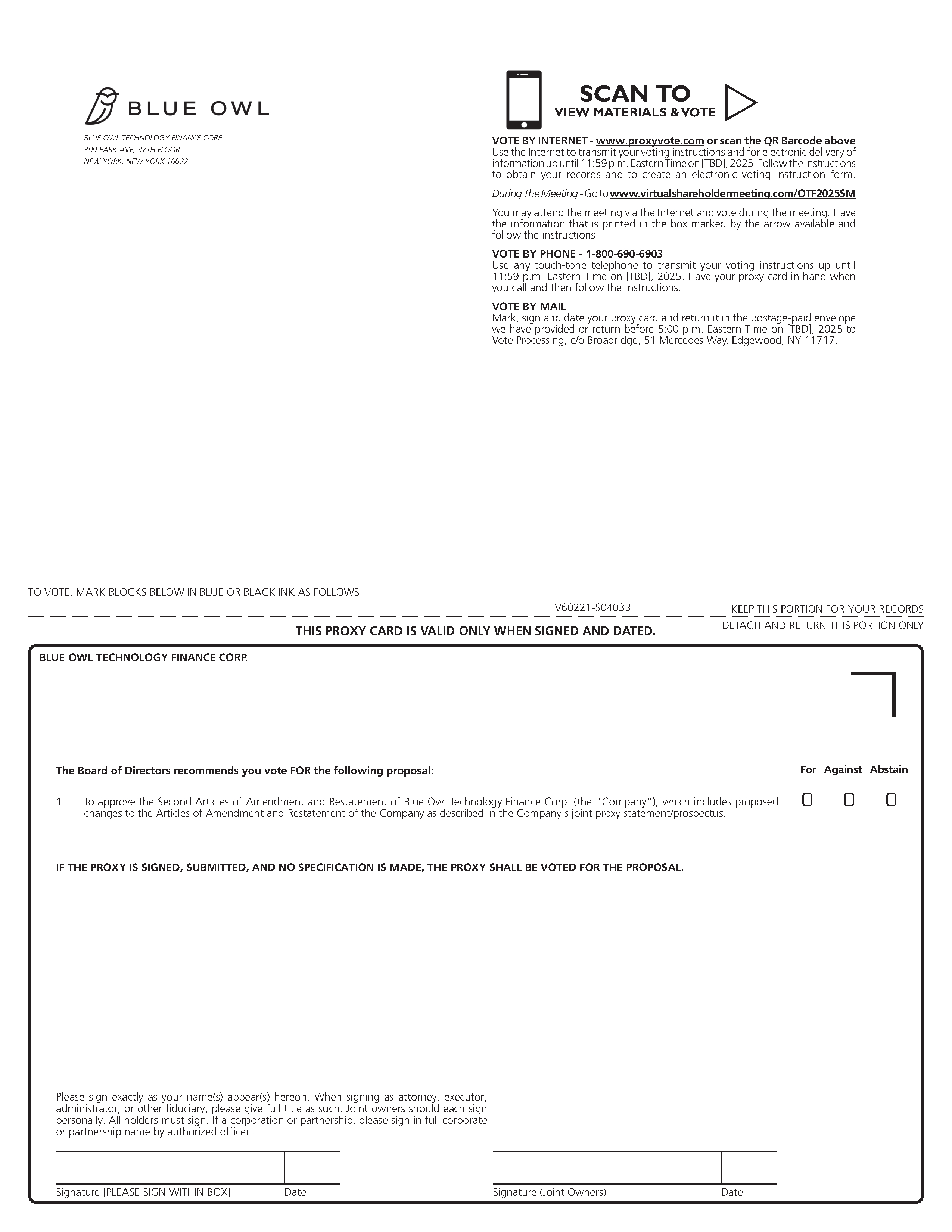

Signature [PLEASE SIGN WITHIN BOX] Date Signature (Joint Owners) Date TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS: KEEP THIS PORTION FOR YOUR RECORDS DETACH AND RETURN THIS PORTION ONLYTHIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED. V60221-S04033 For Against Abstain BLUE OWL TECHNOLOGY FINANCE CORP. 1. To approve the Second Articles of Amendment and Restatement of Blue Owl Technology Finance Corp. (the "Company"), which includes proposed changes to the Articles of Amendment and Restatement of the Company as described in the Company's joint proxy statement/prospectus. The Board of Directors recommends you vote FOR the following proposal: IF THE PROXY IS SIGNED, SUBMITTED, AND NO SPECIFICATION IS MADE, THE PROXY SHALL BE VOTED FOR THE PROPOSAL. Please sign exactly as your name(s) appear(s) hereon. When signing as attorney, executor, administrator, or other fiduciary, please give full title as such. Joint owners should each sign personally. All holders must sign. If a corporation or partnership, please sign in full corporate or partnership name by authorized officer. ! !! BLUE OWL TECHNOLOGY FINANCE CORP. 399 PARK AVE, 37TH FLOOR NEW YORK, NEW YORK 10022 SCAN TO VIEW MATERIALS & VOTEw VOTE BY INTERNET - www.proxyvote.com or scan the QR Barcode above Use the Internet to transmit your voting instructions and for electronic delivery of information up until 11:59 p.m. Eastern Time on [TBD], 2025. Follow the instructions to obtain your records and to create an electronic voting instruction form. During The Meeting - Go to www.virtualshareholdermeeting.com/OTF2025SM You may attend the meeting via the Internet and vote during the meeting. Have the information that is printed in the box marked by the arrow available and follow the instructions. VOTE BY PHONE - 1-800-690-6903 Use any touch-tone telephone to transmit your voting instructions up until 11:59 p.m. Eastern Time on [TBD], 2025. Have your proxy card in hand when you call and then follow the instructions. VOTE BY MAIL Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return before 5:00 p.m. Eastern Time on [TBD], 2025 to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717.

V60222-S04033 BLUE OWL TECHNOLOGY FINANCE CORP. Special Meeting of Shareholders [TBD], 2025 at [TBD] A.M. Eastern Time This proxy is solicited by the Board of Directors The undersigned shareholder of Blue Owl Technology Finance Corp., hereby appoints Neena A. Reddy and Jonathan Lamm, and each of them, as proxies for the undersigned with full power of substitution in each of them, to attend the Special Meeting of Shareholders of Blue Owl Technology Finance Corp. to be held on [TBD], 2025 at [TBD] A.M. Eastern Time, virtually at www.virtualshareholdermeeting.com/OTF2025SM, and any and all adjournments and postponements thereof, with all power possessed by the undersigned as if personally present and to vote in their discretion on such other matters as may properly come before the meeting. The undersigned hereby acknowledges receipt of the Notice of Special Meeting of Shareholders and the accompanying Joint Prospectus/Proxy Statement and revokes any proxy heretofore given with respect to such meeting. This proxy is solicited on behalf of the Blue Owl Technology Finance Corp. board of directors. In their discretion, the proxies are authorized to vote upon such other business as may properly come before the Special Meeting of Shareholders or any adjournments or postponements thereof in accordance with the recommendation of the board of directors or, in the absence of such a recommendation, in their discretion, including, but not limited to, matters incident to the conduct of the meeting or a motion to adjourn or postpone the meeting to another time and/or place for the purpose of soliciting additional proxies for the proposal referenced herein. If you sign, date and return this proxy, it will be voted as directed, or if no direction is indicated, will be voted in accordance with the Board of Directors' recommendations. Continued and to be signed on reverse side Important Notice Regarding the Availability of Proxy Materials for the Special Meeting: The Notice and Joint Prospectus/Proxy Statement are available at www.proxyvote.com. NOTICE IS HEREBY GIVEN THAT the special meeting of shareholders (the “Special Meeting”) of Blue Owl Technology Finance Corp., a Maryland corporation (the “Company”), will be held on [TBD], 2025 at [TBD] a.m. Eastern Time. The Special Meeting will be a completely virtual meeting, which will be conducted via live webcast. You will be able to attend the Special Meeting online and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/OTF2025SM. YOUR VOTE IS VERY IMPORTANT! Your immediate response will help avoid potential delays and may save the Company significant additional expenses associated with soliciting Shareholder votes.

Annex B

16

slide1

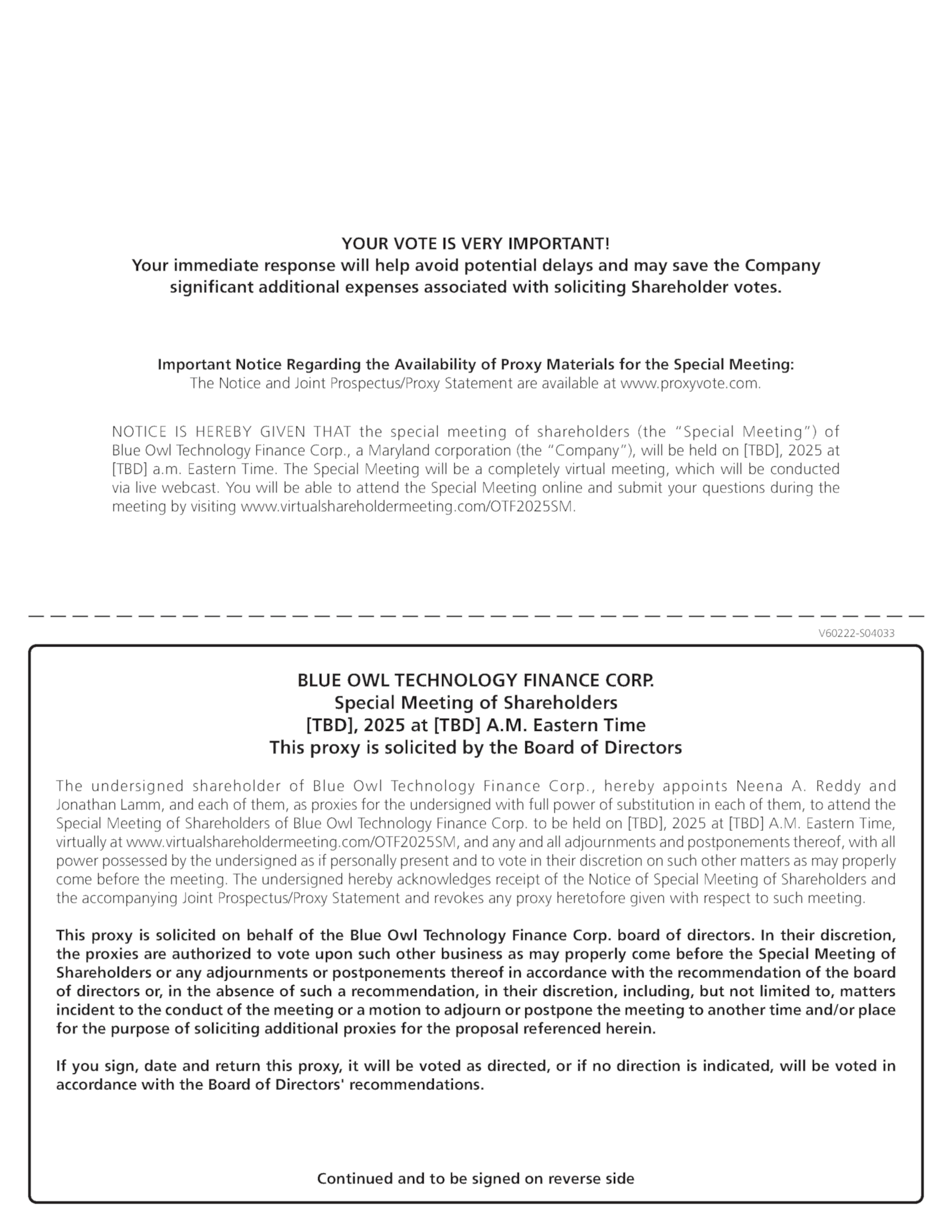

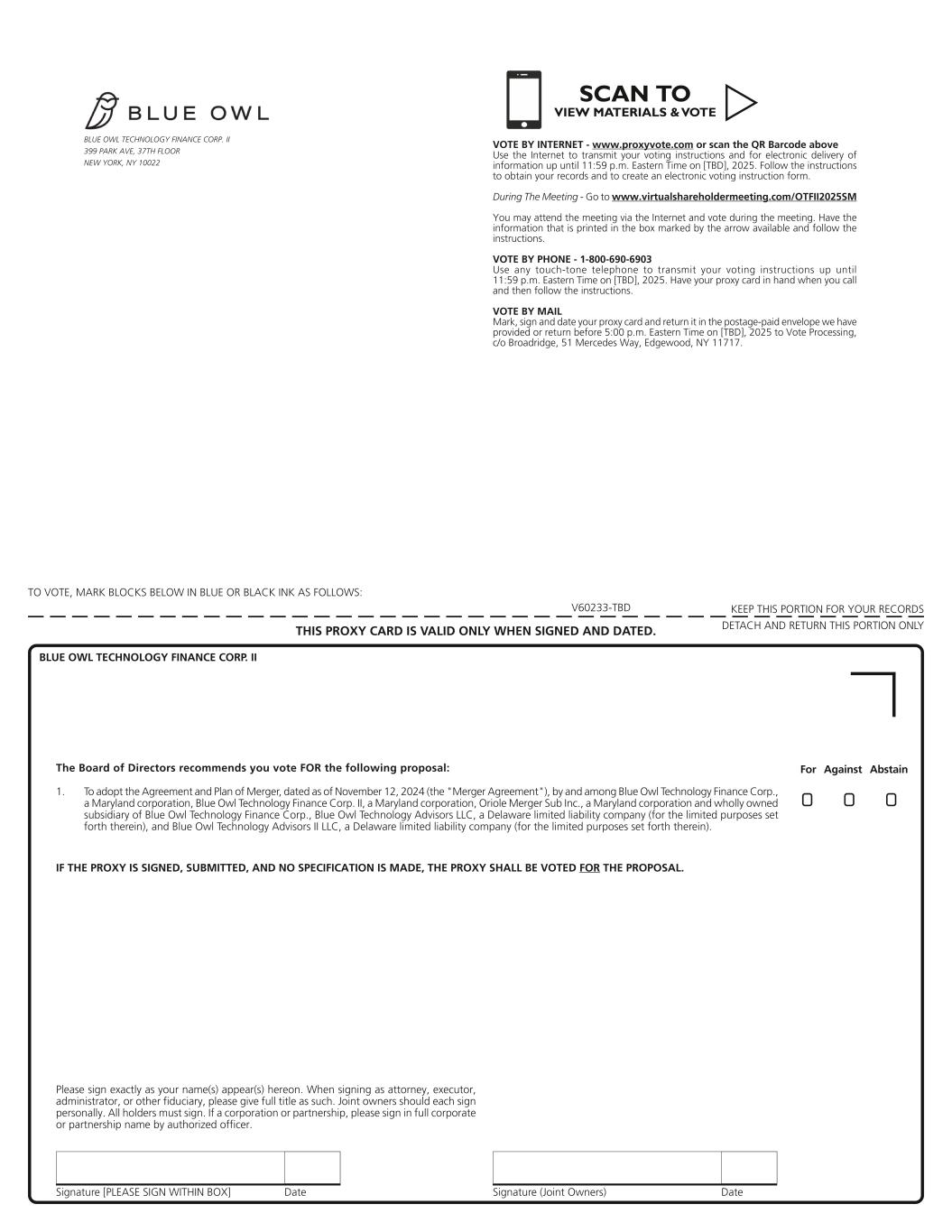

Signature [PLEASE SIGN WITHIN BOX] Date Signature (Joint Owners) Date TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS: KEEP THIS PORTION FOR YOUR RECORDS DETACH AND RETURN THIS PORTION ONLYTHIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED. V60233-TBD For Against Abstain ! !! BLUE OWL TECHNOLOGY FINANCE CORP. II 399 PARK AVE, 37TH FLOOR NEW YORK, NY 10022 BLUE OWL TECHNOLOGY FINANCE CORP. II 1. To adopt the Agreement and Plan of Merger, dated as of November 12, 2024 (the "Merger Agreement"), by and among Blue Owl Technology Finance Corp., a Maryland corporation, Blue Owl Technology Finance Corp. II, a Maryland corporation, Oriole Merger Sub Inc., a Maryland corporation and wholly owned subsidiary of Blue Owl Technology Finance Corp., Blue Owl Technology Advisors LLC, a Delaware limited liability company (for the limited purposes set forth therein), and Blue Owl Technology Advisors II LLC, a Delaware limited liability company (for the limited purposes set forth therein). The Board of Directors recommends you vote FOR the following proposal: IF THE PROXY IS SIGNED, SUBMITTED, AND NO SPECIFICATION IS MADE, THE PROXY SHALL BE VOTED FOR THE PROPOSAL. Please sign exactly as your name(s) appear(s) hereon. When signing as attorney, executor, administrator, or other fiduciary, please give full title as such. Joint owners should each sign personally. All holders must sign. If a corporation or partnership, please sign in full corporate or partnership name by authorized officer. SCAN TO VIEW MATERIALS & VOTEw VOTE BY INTERNET - www.proxyvote.com or scan the QR Barcode above Use the Internet to transmit your voting instructions and for electronic delivery of information up until 11:59 p.m. Eastern Time on [TBD], 2025. Follow the instructions to obtain your records and to create an electronic voting instruction form. During The Meeting - Go to www.virtualshareholdermeeting.com/OTFII2025SM You may attend the meeting via the Internet and vote during the meeting. Have the information that is printed in the box marked by the arrow available and follow the instructions. VOTE BY PHONE - 1-800-690-6903 Use any touch-tone telephone to transmit your voting instructions up until 11:59 p.m. Eastern Time on [TBD], 2025. Have your proxy card in hand when you call and then follow the instructions. VOTE BY MAIL Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return before 5:00 p.m. Eastern Time on [TBD], 2025 to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717.

slide2

V60234-TBD Important Notice Regarding the Availability of Proxy Materials for the Special Meeting: The Notice and Joint Prospectus/Proxy Statement are available at www.proxyvote.com. NOTICE IS HEREBY GIVEN THAT the special meeting of shareholders (the “Special Meeting”) of Blue Owl Technology Finance Corp. II, a Maryland corporation (the “Company”), will be held on [TBD], 2025 at [TBD] a.m. Eastern Time. The Special Meeting will be a completely virtual meeting, which will be conducted via live webcast. You will be able to attend the Special Meeting online and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/OTFII2025SM. YOUR VOTE IS VERY IMPORTANT! Your immediate response will help avoid potential delays and may save the Company significant additional expenses associated with soliciting Shareholder votes. BLUE OWL TECHNOLOGY FINANCE CORP. II Special Meeting of Shareholders [TBD], 2025 at [TBD] a.m. Eastern Time This proxy is solicited by the Board of Directors The undersigned shareholder of Blue Owl Technology Finance Corp. I I, hereby appoints Neena A. Reddy and Jonathan Lamm, and each of them, as proxies for the undersigned with full power of substitution in each of them, to attend the 2025 Special Meeting of Shareholders of Blue Owl Technology Finance Corp. II to be held on [TBD], 2025 at [TBD] a.m. Eastern Time, virtually at www.virtualshareholdermeeting.com/OTFII2025SM, and any and all adjournments and postponements thereof, with all power possessed by the undersigned as if personally present and to vote in their discretion on such other matters as may properly come before the meeting. The undersigned hereby acknowledges receipt of the Notice of Special Meeting of Shareholders, the accompanying Joint Prospectus/Proxy Statement and revokes any proxy heretofore given with respect to such meeting. This proxy is solicited on behalf of the Blue Owl Technology Finance Corp. II board of directors. In their discretion, the proxies are authorized to vote upon such other business as may properly come before the 2025 Special Meeting of Shareholders or any adjournments or postponements thereof in accordance with the recommendation of the board of directors or, in the absence of such a recommendation, in their discretion, including, but not limited to, matters incident to the conduct of the meeting or a motion to adjourn or postpone the meeting to another time and/or place for the purpose of soliciting additional proxies for any or all of the proposals referenced herein. If you sign, date and return this proxy, it will be voted as directed, or if no direction is indicated, will be voted in accordance with the Board of Directors' recommendations. Continued and to be signed on reverse side

slide2

V60234-TBD Important Notice Regarding the Availability of Proxy Materials for the Special Meeting: The Notice and Joint Prospectus/Proxy Statement are available at www.proxyvote.com. NOTICE IS HEREBY GIVEN THAT the special meeting of shareholders (the “Special Meeting”) of Blue Owl Technology Finance Corp. II, a Maryland corporation (the “Company”), will be held on [TBD], 2025 at [TBD] a.m. Eastern Time. The Special Meeting will be a completely virtual meeting, which will be conducted via live webcast. You will be able to attend the Special Meeting online and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/OTFII2025SM. YOUR VOTE IS VERY IMPORTANT! Your immediate response will help avoid potential delays and may save the Company significant additional expenses associated with soliciting Shareholder votes. BLUE OWL TECHNOLOGY FINANCE CORP. II Special Meeting of Shareholders [TBD], 2025 at [TBD] a.m. Eastern Time This proxy is solicited by the Board of Directors The undersigned shareholder of Blue Owl Technology Finance Corp. I I, hereby appoints Neena A. Reddy and Jonathan Lamm, and each of them, as proxies for the undersigned with full power of substitution in each of them, to attend the 2025 Special Meeting of Shareholders of Blue Owl Technology Finance Corp. II to be held on [TBD], 2025 at [TBD] a.m. Eastern Time, virtually at www.virtualshareholdermeeting.com/OTFII2025SM, and any and all adjournments and postponements thereof, with all power possessed by the undersigned as if personally present and to vote in their discretion on such other matters as may properly come before the meeting. The undersigned hereby acknowledges receipt of the Notice of Special Meeting of Shareholders, the accompanying Joint Prospectus/Proxy Statement and revokes any proxy heretofore given with respect to such meeting. This proxy is solicited on behalf of the Blue Owl Technology Finance Corp. II board of directors. In their discretion, the proxies are authorized to vote upon such other business as may properly come before the 2025 Special Meeting of Shareholders or any adjournments or postponements thereof in accordance with the recommendation of the board of directors or, in the absence of such a recommendation, in their discretion, including, but not limited to, matters incident to the conduct of the meeting or a motion to adjourn or postpone the meeting to another time and/or place for the purpose of soliciting additional proxies for any or all of the proposals referenced herein. If you sign, date and return this proxy, it will be voted as directed, or if no direction is indicated, will be voted in accordance with the Board of Directors' recommendations. Continued and to be signed on reverse side