EX-99.2

Published on June 3, 2025

Exhibit 99.2

|

||

| June 3, 2025 |

Frequently Asked Questions Intention to List

Listing Overview

Blue Owl Technology Finance Corp. published a press release and filed an 8-K on June 3, 2025 announcing its intention to list on the New York Stock Exchange under ticker OTF, another exciting milestone for our platform.

The Company intends to list on or about Thursday, June 12, 2025.

5% of your shares will be available to trade upon listing. The transfer restrictions will expire on the balance of your position in equal portions at each of 180 days, 270 days, and 365 days post-listing.

Share transfer instructions for existing shareholders are available on the Blue Owl Investor Portal at https://blueowl.icapitalnetwork.com/login and additional resources are available publicly on the Companys website at www.blueowltechnologyfinance.com

When does the Company anticipate listing?

We are targeting a listing on or about June 12, 2025.

What will the Companys ticker symbol be and where will the stock trade?

The Company anticipates trading on the NYSE under the ticker symbol OTF.

How will the opening trading price be determined?

Similar to other NYSE IPOs and NYSE listings, the opening price of OTF will be set by the Designated Market Maker (DMM) and based on their determination of where all marketable auction orders will receive an execution.

What will the dividend policy of the Company be following the anticipated listing?

The board of directors of the Company declared a second quarter 2025 regular dividend of $0.35 per share for shareholders of record as of June 30, 2025, payable on or before July 15, 2025.

Additionally, in conjunction with the listing, the Board declared five special dividends of $0.05 per share, payable on a quarterly basis to shareholders of record in accordance with the schedule below.

Dividends Declared

| Declaration Date |

Record Date |

Payment Date |

Dividend Type |

Amount Per Share |

||||

| 6/2/2025 |

6/30/2025 | 7/15/2025 | Base | $0.35 | ||||

| 6/2/2025 |

9/22/2025 | 10/7/2025 | Special | $0.05 | ||||

| 6/2/2025 |

12/23/2025 | 1/7/2026 | Special | $0.05 | ||||

| 6/2/2025 |

3/23/2026 | 4/7/2026 | Special | $0.05 | ||||

| 6/2/2025 |

6/22/2026 | 7/7/2026 | Special | $0.05 | ||||

| 6/2/2025 |

9/21/2026 | 10/6/2026 | Special | $0.05 |

Will there be any changes to the Companys strategy after the anticipated listing?

No, our investment strategy will remain the same.

1

Copyright© Blue Owl Technology Finance Corp. 2025. All rights reserved.

|

||

| June 3, 2025 |

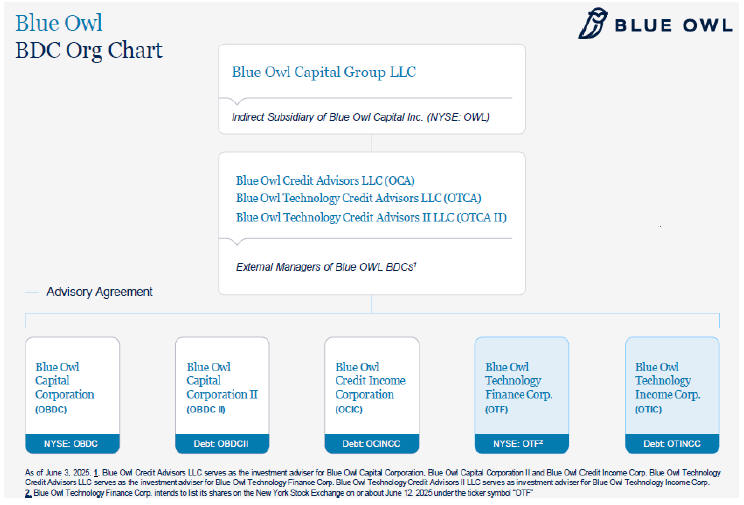

What is the relationship between the Company, Blue Owl Capital Corporation (NYSE: OBDC) and Blue Owl Capital (NYSE: OWL)?

Both Blue Owl Technology Finance Corp. and Blue Owl Capital Corporation are BDCs, both managed by indirect affiliates of Blue Owl Capital Inc. (Blue Owl) (NYSE: OWL) and part of the Blue Owl Credit platform.

Existing Investors

What will happen to the shares that I own after an anticipated listing?

Nothing will happen to the shares you own. Shares will continue to be held through the Companys transfer agent, State Street Bank and Trust Company, until transferred to your broker/custodian. To the extent you own fractional shares, those will be rounded up to the nearest whole share. This share adjustment will be memorialized in your 2Q25 quarterly statement.

What are my options at the time of the listing?

Buy: You may choose to purchase shares through your broker-dealer after the listing.

Hold: You may continue to hold your shares and there is no action required of you at this time. You will receive future dividends already declared and any additional dividends that may be declared in the future.

Sell: You may choose to sell your tradeable shares by following the transfer instructions in the Blue Owl Investor Portal. Should you wish to trade your shares on June 12, 2025, you must complete this process before June 12, 2025.

2

Copyright© Blue Owl Technology Finance Corp. 2025. All rights reserved.

|

||

| June 3, 2025 |

How much of my position will be freely tradeable at the time of the anticipated listing?

5% of each investors position will be released from the lock-up period outlined in the Companys Charter. Provided you are not an affiliate of the Company, shares released from the lock-up period will be freely tradeable at the time of the anticipated listing once transferred to a broker/custodian. Each investor should consult the Blue Owl Investor Portal for their exact share count that will be released from lock-up, share transfer instructions, and any other information specific to their circumstances.

What are the terms of the lock-up on the remainder of each investors position?

The remaining shares will be subject to the lock-up and will be released as follows:

| | One third of remaining shares released 180 days after the listing date |

| | One third of remaining shares released 270 days after the listing date |

| | One third of remaining shares released 365 days after the listing date |

All investors will be subject to the same lock-up structure.

| Date |

% of Shares Released |

|||

| At Listing | 06/12/2025 | 5% | ||

| +180 Days | 12/09/2025 | 33% of Remaining Position | ||

| +270 Days | 03/09/2026 | 33% of Remaining Position | ||

| +365 Days | 06/12/2026 | 33% of Remaining Position |

Will I continue to receive dividends?

Yes, all shareholders will continue to receive or reinvest dividends in accordance with their election.

What is the Companys CUSIP number?

095924106

Who is the Companys transfer agent?

State Street Bank & Trust Company

Where can I find additional resources?

Additional information including SEC filings and our investor presentation can be found at the Companys website, www.blueowltechnologyfinance.com

Share transfer instructions specific to each investor can be found within the Blue Owl Investor Portal.

3

Copyright© Blue Owl Technology Finance Corp. 2025. All rights reserved.